No-deposit options: the newest pattern your cannot forget about

Not surprisingly, a lot of people fool around with PayPal to deliver currency, so it is a handy choice for money transmits away from normal bank account. More often than not, such charges is $15 and are recharged once a month until a deal are produced. Just remember that , some financial institutions and you may borrowing from the bank unions obtained’t charges inactivity charge, otherwise just charge them if the balance is below a specific amount. Meanwhile, of several banks have a tendency to fees people to have leaving a savings account entirely inactive. If you wear’t done people purchases with your checking account for a long time—typically 1 year—your own bank can charge you inactivity costs. Thus, you will find always a threshold of half dozen free withdrawals open to your within this a given declaration period.

Misc Services

One of many financial institutions one to accept undocumented immigrants is Wells Fargo, PNC, U.S. Lender, BMO Harris, Alliant Credit Partnership, Lender out of America, HSCB, and you can TD Bank. This will ensure that he’s well prepared to changeover to help you an alternative country and remove the pressure out of looking after funds within the a currently exhausting procedure for moving to a new nation. Us Bank account for Foreign Nationals might be an effective way to handle your You investing if you are overseas.

Say goodbye to shelter deposits.

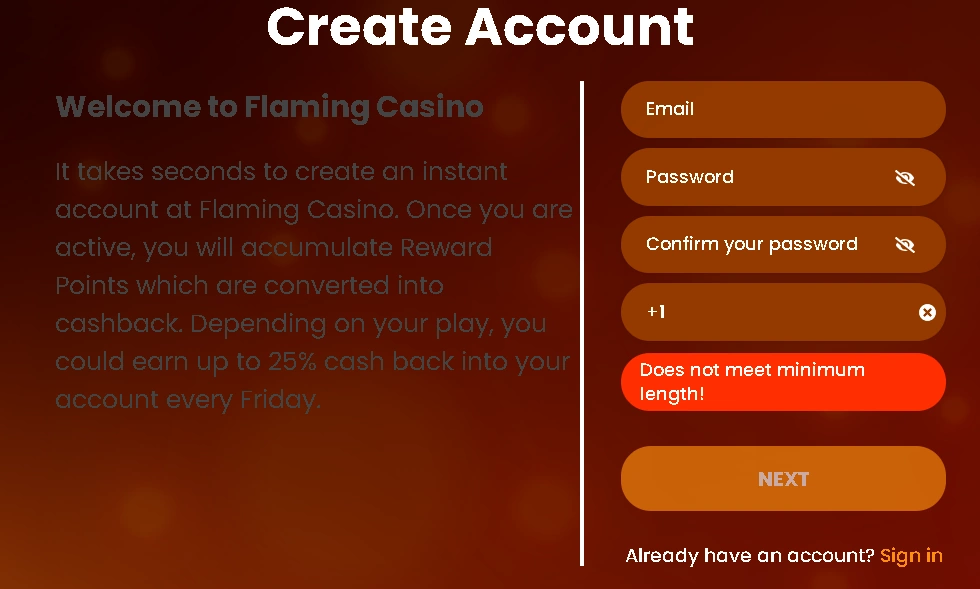

A no deposit incentive ‘s the best approach to help you kickstart the internet casino sense. Get a way to earn real money without the need to deposit an individual cent! No-deposit incentives are great for trying out the brand new casinos instead people economic partnership. Just remember that , PayPal’s charge can sometimes be high, and their exchange rates are often higher than the individuals utilized by competitors. The major downside to correspondent financial would be the fact it’s both slow and you can pricey. Rather than domestic immediate money transmits, the new Swift circle does take time due to the contacts sometimes necessary to-arrive a different lender.

Annual Payment Give (APY) try exact as of XX/XX/XXXX, is actually susceptible to changes with no warning, and you will be determined and repaired to your name from the financing. It’s plans the spot where the citizen will pay a non-refundable fee every month (or superior), so long as the brand new resident provides a rental. The fresh fee every month will be based upon the new citizen’s credit score which can be paid directly to Rhino. Inside the application processes, you will see an excellent checkbox for the Put Waiver choice.

But not, be mindful one exchange offers threats, and lose the whole funding. Typically, you’ll need to establish who you are, get your bag establish, and often you’ll want to participate in certain first exchange or fund your bank account having the absolute minimum deposit. With respect to the exchange’s rules, you might need to verify your bank account. That it confirmation processes usually involves taking personality data to make certain defense and you can conformity with regulations.

Beginning a bank account on the net is constantly limited to people only, if you don’t’re also having fun with a major international otherwise correspondent account (come across lower than). The new Axos Financial Benefits Checking account offers an absolute mixture of provides. And also the bank will bring unlimited reimbursements to own domestic out-of-network Atm charges. The services on the Tradersunion.com website is actually 100 percent free to work with.

To join PenFed, you must unlock a family savings and you can deposit at the least $5. You could potentially’t availableness the brand new bank account instead an casino dunder login page excellent PenFed family savings. The put option provider makes you stop lost book and you can damages, market straight down flow-inside the options and relieve crappy debt instead losing leases out of higher protection places. This is why you should only purchase money that you will be waiting — or are able to afford — to reduce during the for example high risks. Tradersunion.com cannot render people financial characteristics, as well as funding or economic consultative characteristics.

New registered users is allege a welcome provide package well worth up to six,2 hundred USDT from the joining, and then make the first deposit, and completing investments inside one week. As well, for each friend referred, users is earn an extra two hundred USDT in the perks. Each day view-in and activity conclusion give next chances to accumulate issues, which can be used to possess exchange incentives and you can USDT. That have every day and enough time-name incentives, Bitget provides users involved and you will rewards energetic contribution to your platform. The newest HTX Hobbies Cardiovascular system now offers a selection of benefits for the brand new and you can present users. Participants can also be unlock various rewards from the finishing tasks such as signing right up, and then make their earliest put, otherwise change.

You’ll gain access to Zelle to deliver and receive money, online and mobile banking, an internet-based expenses spend provides also. RFC Repaired Deposit provides NRIs that have gone back to Asia a good a good chance to secure higher productivity to the finance they keep in the foreign currency. Even if you is also’t discover a All of us bank account, or you have to control your money whilst you wait to start one to, you can still find available options to you personally. While you are an international account is a superb replacement a consistent United states family savings, it indeed aren’t for everyone.

The common interest to own a destination-making checking account is 0.07% within the December 2024, depending on the Federal Deposit Insurance policies Corporation (FDIC). Several of the most popular are month-to-month repair charge, minimal harmony costs, overdraft charges and you can Atm charges. An excellent $15 month-to-month fix fee, for example, manage ask you for $180 a-year. That it account brings together one another checking and offers have, therefore based on debt requirements, it may meet your needs.

Lose shelter threats

Contemplate using an online private network (VPN) for additional security whenever performing online financial deals exterior your property community. Maintaining a non-resident savings account means patient government and you may a proactive approach to defense. Productive administration reduces potential things and guarantees seamless access to the finance.

Anyone or entity have FDIC insurance coverage inside the an insured bank. Men need not become a You.S. resident otherwise resident to own his or her dumps covered by the the brand new FDIC. For those who’re also residing the usa but i have yet for resident condition, you could potentially submit an application for a bank checking account in person. Online services are usually limited by People in the us and permanent owners simply. As the opening a vintage bank account will be problematic to possess non-owners, you can turn to other options, such an excellent multiple-money account, an international membership, and you can a good correspondent membership.

It’s as well as perfect for people who don’t overdraft the accounts have a tendency to. Axos offers 24/7 customer care through mobile phone and safer on the web chatting. The website also has a live speak function available through the regular regular business hours. For careful, multiple training courses and courses render a danger-100 percent free solution to get crypto change degree.